Investment Tips: How to prepare the portfolio amid rising inflation and the risk of recession? Where to invest money is beneficial – How to prepare your portfolio amidst risk and the threat of recession

Last updated:

Money Making Tips – The purpose of investing money in the stock market is more in the short term. However, experts believe that you should set foot for a long time in the stock market. Ris in the short term in equity market …Read more

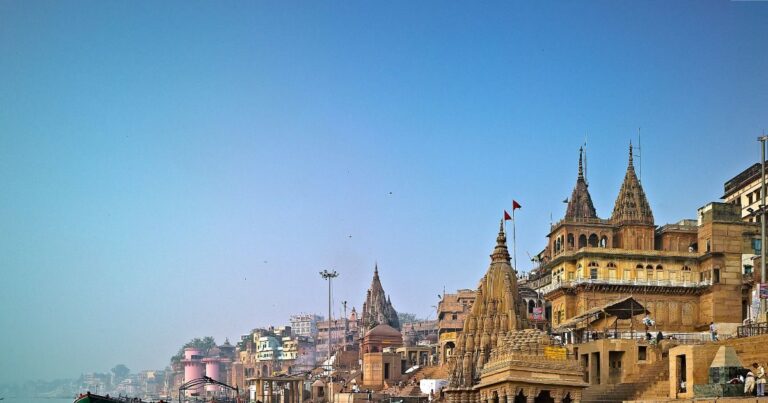

Investment in gold protects you from the rapid turmoil of the market.

New Delhi. This year was not as much better for investors as it was 2021. Despite the impact of Kovid-19, Indian markets then gave tremendous returns to investors. However, Ukraine-Russia in 2022, rising inflation due to high prices of crude oil, strict monetary policies and fear of recession broke the back of the money market. The situation looks more or less similar for some time. In such a situation, what options do people have for investment?

Why should you have a strategy for your investment at such a time. It is very important to understand where and how much you should invest. If you make decisions related to your investment thoughtfully, then it is certain that the effect of any big upheaval in the market will not be much on you. Today we will tell you how to prepare your portfolio?

Also read- The first pilot trial of digital rupee will start from today, 9 banks will take part, see details

Do not invest money only in equity

The purpose of investing money in the stock market is more in the short term. However, experts believe that you should set foot for a long time in the stock market. Of course, equity has the ability to give you more returns in less time than any other asset, but the risk factor in it is equally higher. Therefore, instead of putting all your investment in shares, pay attention to date and gold. According to experts, according to the ability to take your risk, you can distribute investment in these assets. Suppose you have the ability to take more risk, then invest in equity, date and gold in ratio of 70-25-5. If you want to take a medium level risk, then make this ratio 45-45-10. Whereas if you want to take the risk very little, make it 20-70-10. Equity can currently be invested in large and mid -cap and multicap category. Whereas in date you can see maturity funds and dynamic bonds.

Why separate asset class?

Investment experts believe that uncertainty in the market still remains. The global trends in the short term are also not looking better. In such a situation, focusing on any one asset class can prove to be wrong. Instead, people should pay attention to different asset classes. According to experts, how much risk you can take and how much time you can spend in the market, you should invest only keeping these 2 factors in mind. This is why experts are advising the portfolio to distribute the equity, goal and date.

Investment in gold

Usually people invest in gold because if they are incurring losses in other asset classes, then they get some support here. Therefore, 10 percent of the portfolio is standardly applied in gold. Sovereign gold bonds can be seen for investment in gold. In this, an additional benefit of 2.5 percent in the annual return is available. Investing in gold provides protection during market uncertainty.